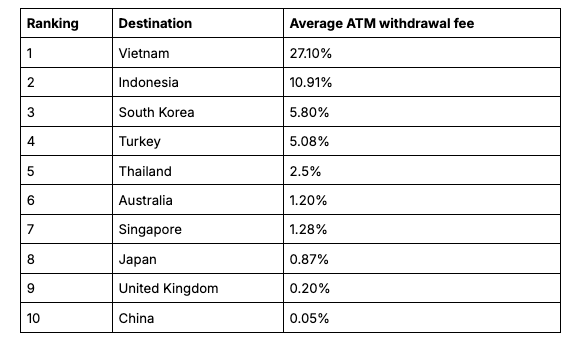

Kuala Lumpur, Malaysia, 29 July 2025 – As Malaysians gear up for the MATTA fairs in August and plan their year-end getaways, Wise, the global technology company building the best way to move and manage money around the world, today revealed new data on the hidden cost of withdrawing cash from ATMs abroad. This timely insight serves as a crucial reminder for budget-savvy travellers to maximise their travel budgets by understanding and avoiding exorbitant ATM fees.

Malaysians are renowned for their love of travel and their knack for sniffing out the best deals. However, many overlook a crucial aspect of travel budgeting: the fees associated with accessing cash overseas. While a flight or hotel deal might seem like a steal, hidden ATM charges can quickly erode those savings.

"Malaysians have a knack for uncovering fantastic travel deals, yet the joy of these savings can be overshadowed by unexpected fees at their destination," says Yee Won Nyon, Senior Product Manager at Wise. "Our latest data reveals significant disparities in ATM fees across countries, which can affect how far your ringgit can truly go. Travel should be about creating cherished memories, not fretting over hidden costs. By understanding these fees, Malaysians can ensure their ringgit goes further, allowing them to focus on enjoying their journey."

- Always pay in local currency: When an ATM or card machine offers to process your transaction in your home currency (MYR), always decline and choose the local currency instead. Always choose to pay in the local currency to avoid Dynamic Currency Conversion fees.

- Know your card fees. Although most providers allow withdrawals overseas, these are usually very expensive. Check what fees your card provider charges for overseas withdrawals.

- Use a multi-currency card. Some providers may offer free ATM withdrawals abroad up to a certain threshold. The Wise card allows free withdrawals twice a month for amounts under MYR 1,000.

- Withdraw strategically:

- Use bank-owned ATMs: Stick to ATMs located directly at banks during their opening hours. These are generally more secure and less likely to charge additional fees than standalone ATMs in tourist areas.

- Make fewer but larger withdrawals: If your card has a flat fee per withdrawal, taking out a larger sum less frequently can save money compared to many small withdrawals.

- Check daily limits: Be aware of both your bank's daily withdrawal limit and any limits imposed by the foreign ATM.

These data are based on 9.7 million ATM withdrawals made with a Wise card over a 6-month period, from February 2025 to July 2025. These ATMs recorded at least 500 transactions per country during the 6-month period. The percentage represents the average ATM fees in a given country and does not account for hidden fees in exchange rates.

About Wise

Wise is a global technology company, building the best way to move and manage the world's money.

With Wise Account and Wise Business, people and businesses can hold 40 currencies, move money between countries and spend money abroad. Large companies and banks use Wise technology too; an entirely new network for the world's money. Launched in 2011, Wise is one of the world’s fastest growing, profitable tech companies.

In fiscal year 2025, Wise supported around 15.6 million people and businesses, processing over $185 billion in cross-border transactions and saving customers around $2.6 billion.

Contact details

Related topics

Related news

Wise becomes first non-bank in the Philippines to launch Google Pay for Wise account and Wise Business cardholders

Both Wise Account & Wise Business customers can now add their Wise cards to Google Pay on their Android devices and make fast, secure contactless transactions in-store, online, in-app, and on publi...

Think you saved on travel deals? Malaysians lose up to RM350 per trip despite spending days hunting for deals

Wise teams up with content creator Adam Izzy to expose the hidden fees at year-end travel pop-up at Starhill Piazza

GoTyme Bank and Wise Platform Team Up to Make International Remittances Seamless for Millions of Filipinos

GoTyme Bank, the fastest-growing bank in the Philippines becomes the first Wise Platform partner in the country, unlocking faster and more transparent cross-border payments for over 7.8 million cus...

How to Travel Smart and Stretch Your Peso this Holiday Season

Wise recently revealed the most expensive places to withdraw cash overseas – and some of Filipinos’ favourite travel hotspots are the worst offenders.

Wise launches Wise Business Account, empowering Filipino MSMEs to scale globally with ease

This comprehensive business account solution enables Filipino MSMEs, which comprise 99.6%3 of all businesses in the Philippines, to pay and get paid globally, manage 40+ currencies, and expand inte...